MUNICH, Germany – Siemens Energy today announced its results for the first quarter of fiscal year 2025 that ended December 31, 2024.

MUNICH, Germany – Siemens Energy today announced its results for the first quarter of fiscal year 2025 that ended December 31, 2024.

“Our strong first quarter reflects the market opportunities arising from the increasing demand for electricity. The strong cash flow was mainly driven by growth across all our businesses, advance payments and timing effects. Our focus lies still on profitable topline growth and technological leadership,” said Christian Bruch, President and CEO of Siemens Energy AG.

- Siemens Energy got off to a strong start to this new fiscal year. Demand for our products remained favorable and the strong order trends continued. The prior-year quarter’s figures for revenue, Profit before Special items and cash flow were clearly exceeded. All segments contributed to the improvements.

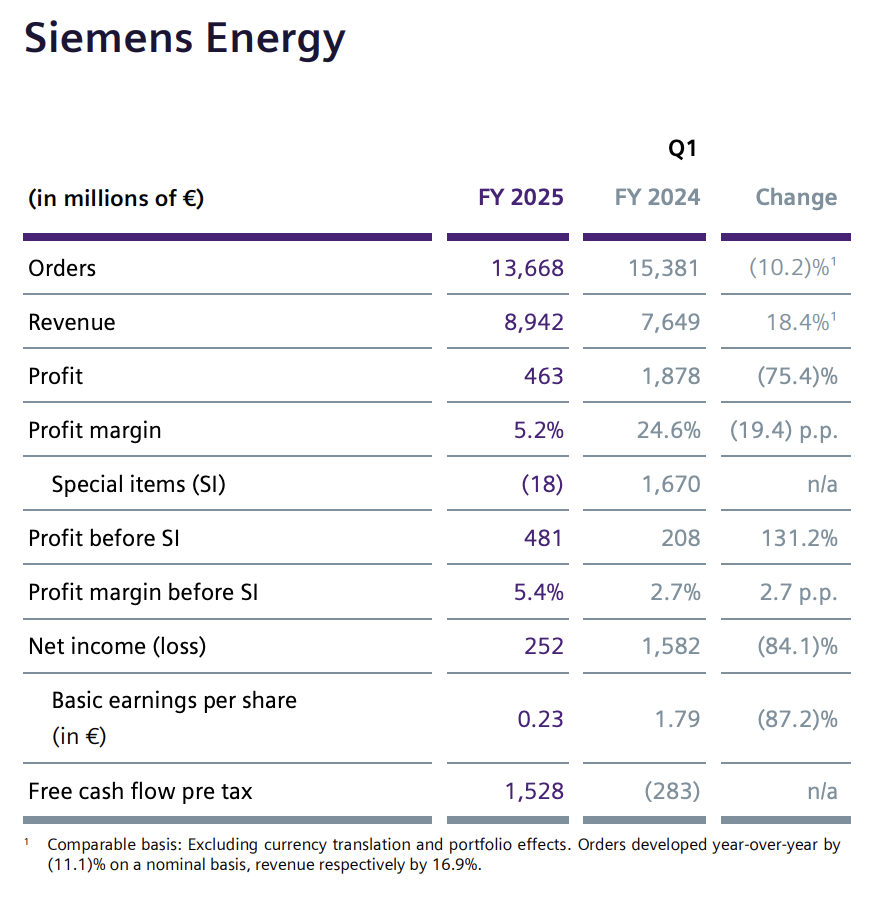

- Orders of Siemens Energy amounted to €13.7bn. As expected, this was below the high level of the prior-year quarter, in which Grid Technologies and Transformation of Industry had booked exceptionally high orders. Book-to-bill ratio (ratio of orders to revenue) was 1.53, leading to a recordorder backlog of €131bn.

- Revenue of €8.9bn increased by 18.4% on a comparable basis (excluding currency translation and portfolio effects) with all segments recording growth.

- Profit before Special items of Siemens Energy more than doubled year-over-year to €481m (Q1 FY 2024: €208m) again held back by results of Siemens Gamesa, but to a significantly lesser extent than in the prior-year quarter. Special items amounted to negative €18m (Q1 FY 2024: positive €1,670m, in connection with disposals). Siemens Energy’s Profit came in at €463m (Q1 FY 2024: €1,878m).

- Net income was €252m (Q1 FY 2024: €1,582m). Corresponding basic earnings per share were €0.23 (Q1 FY 2024: €1.79).

- Free cash flow pre tax was materially stronger than expected at positive €1,528m (Q1 FY 2024: negative €283m) driven by project advance payments and timing effects of customer payments. All segments contributed to the improvement.

- Based on the development in the first quarter, management now expects that Siemens Energy will exceed the current Free cash flow pre tax guidance of up to €1bn and therefore intends to update the Free cash flow pre tax outlook for fiscal year 2025 with the half-year results for fiscal year 2025.

- Despite considerable increases at Gas Services and Siemens Gamesa, orders declined year-over-year due to the exceptionally high prior year level at Grid Technologies and Transformation of Industry. The share of the service business increased sharply compared with the prior-year quarter. Nevertheless, the clear majority of orders were attributable to the new units business.

- Book-to-bill ratio was strong at 1.53. Order backlog once again exceeded the previous record level and rose to €131bn.

- Revenue increased due to significant growth in both the new units and service business.

- Profit before Special items and the corresponding margin rose sharply. All segments showed profit improvements. This was driven by increased volume, processing higher margin order backlog and the strong operational performance thereby. In addition, the business mix was more favorable than a year ago.

- In the prior year, Special items included the pre-tax gain from the sale of an 18 percent share in the centrally held stake in Siemens Limited, India.

- Development of Free cash flow pre tax was due to sharp improvements in all segments. This was driven by customer advance payments and timing effects, including accelerated payments from customer side.

Outlook

For fiscal year 2025, we continue to anticipate overall favorable conditions in Siemens Energy’s relevant market environment. Strong electricity consumption growth, replacement investment and the requirements of the energy transition necessitate investment in energy infrastructure sup-porting all businesses of Siemens Energy. At Siemens Gamesa we continue to work on the measures to reach break-even in fiscal year 2026. We continue to strive for resume sales activities for the 5.X onshore turbine during fiscal year 2025.

We expect for Siemens Energy to achieve comparable revenue growth (excluding currency translation and portfolio effects) in fiscal year 2025 in a range of 8 % to 10 % and a Profit margin before Special items between 3 % and 5 %. We expect Net income to be around break-even excluding assumed positive Special items subsequent to the demerger of the energy business from Siemens Limited, India. Due to the development in the first quarter, we now expect to exceed the previous Free cash flow pre tax guidance of up to €1bn. We intend to update the Free cash flow pre tax outlook with the half-year results for fiscal year 2025.

The outlook for Siemens Energy does not include charges related to legal and regulatory matters.

Overall assumptions per business area:

- Gas Services assumes a comparable revenue growth of 7 % to 9 % and a Profit margin before Special items of 10 % to 12 %.

- Grid Technologies plans to achieve a comparable revenue growth of 23 % to 25 % and a Profit margin before Special items between 10 % and 12 %.

- Transformation of Industry expects a comparable revenue growth of 11 % to 13 % and a Profit margin before Special items of 8 % to 10 %.

- Siemens Gamesa assumes a comparable revenue growth of negative 9 % to negative 5 % and a negative Profit before Special items of around €1.3bn.